This is another adapted essay from my classes. This particular essay was my paper for my Monetary Policy class in the spring of 2015. I’ve cleaned it up a little, and adapted it for a blog format, but it is largely as it was in the spring of 2015.

Inflation and hyperinflation is a topic that isn’t always well-understood by the general public. Those who know nothing about how inflation and hyperinflation work tend to believe that moderate inflation is good, and hyperinflation is bad—not the worst impression in the world, but also not a terribly accurate one. Fortunately for the uninformed (which included me), the author of Monetary Regimes and Inflation, Peter Bernholz, is a bona fide expert on the subject of inflation (and literally wrote the book on it).

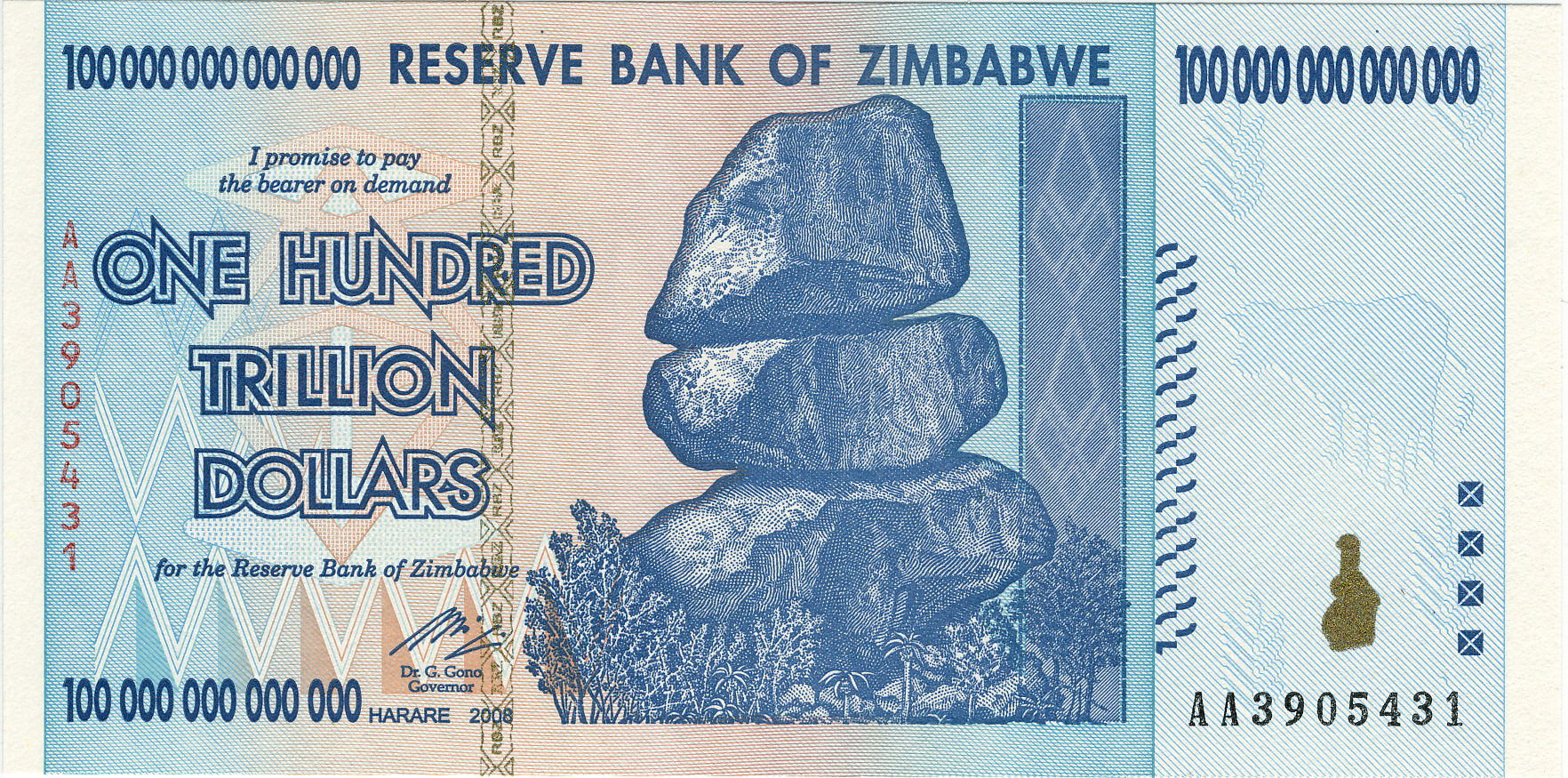

Bernholz spends much of his book discussing what a hyperinflation is, and how it should be ended. According to him, to end a hyperinflation you must replace the hyperinflating currency with another. A hyperinflation, defined in this essay as when the monthly inflation rate goes above fifty percent, is a death-knell for a currency. Public trust in it has been eroded to the point where it is extremely unlikely that it will recover; foreign banks will refuse it; its effective value is near or at zero, and it is poisoning your economy. Replacing it with a new currency will allow Thiers’ Law to come into effect so that the new, non-hyperinflating currency can drive out the older currency and restore some order to the economy.

But how do more moderate inflations start? We know that constant inflation is a relatively recent occurrence, since, until all currencies became fiat, there was always a hard cap on how much money could be printed—namely, a certain multiple of the value of the gold a nation had on hand. Prior to fiat currency, inflation would occur in a couple of different ways. During wartimes, when convertibility was suspended, currency would often be inflated as a tax to fund the war; when a large stock of whatever backed a currency was discovered, that currency would inflate as the stock entered the money supply (which is why we don’t use leaves as currency—the ability to say that money does grow on trees would probably have deleterious effects on our economy [1]Notably, this failed completely in Douglas Adams’ The Restaurant at the End of the Universe; after adopting the leaf as a form of currency, and then suffering from massive inflation, a … Continue reading); by changing the convertibility of your currency to its commodity backing, you could change the value of your currency and cause inflation.

Milton Friedman was of the opinion that inflation is undesirable for an economy. A subscriber of the Quantity Theory of Money, he believed that Keynesian economics “[ignored] the theory and historical evidence that linked inflation to excessive growth in the money stock and depression to money shrinkage” (White 313). He supported the suspension of gold convertibility in 1971, as he hoped it would lead to tighter restrictions on the money supply, lowering inflation (White 309). He supported the 1970 appointment of his friend and mentor, Arthur Burns, as the Chairman of the Federal Reserve for the same reason (White 306). Unfortunately for him, his hopes were dashed on both counts—Burns ended up advocating for measures Friedman strongly disagreed with, and the ending of the Bretton Woods system did not end either money growth or inflation.

In fact, Nixon’s ending of the Bretton Woods gold convertibility program, which was originally established in 1944, did exactly the opposite of what Friedman wanted. Up until the convertibility was dissolved, every country had fixed the price of its currency relative to the U.S. Dollar; the dollar was the world’s reserve currency, and was exchangeable (for monetary authorities, if not the general public) for gold. When Nixon ended that convertibility in 1971, it sparked a series of inflations around the world.

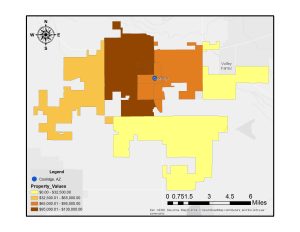

To combat this and end the inflation, many countries joined the European Monetary System (which began in 1972, and continued until 1978). Known as the European “Currency Snake”, its goal was to fix the value of each currency relative to each other, and limit inflation, which it did by requiring member countries to keep the exchange rates of their different currencies within a narrow band (within ±2.25% of other member currencies) (Higgins 4). Countries were not required to remain in the Snake (France exited the Snake in 1974, re-entered in 1975, and exited again in 1976), but those countries in the Snake tended to have lower inflation rates (Germany’s inflation rate from 1973-1977 was 5.34 percent; France’s inflation rate was 10.24 percent) (Bernholz 153). Officially the Snake didn’t rely on one currency to value the others, but in practice the Deutschmark was used to value the other currencies due to the highly stable nature of the German Bundesbank (Higgins 4).

After the collapse of the Snake in 1978, the European Exchange Rate Mechanism was established in 1979 to do basically the same thing. And, functionally speaking, very little changed. The required exchange rates between countries were left unchanged, the Deutschmark was used to value other currencies, and inflation rates in member countries tended to be lower than rates in non-member countries (Higgins).

Besides pegging your currency to another, more stable currency (or to a group of other currencies), what can you do to combat moderate inflation? It turns out that moving onto a metallic-based currency works rather well. According to Bernholz, Argentina experienced a period of higher-than-desired inflation in the 1890s (Bernholz 146). After a series of bank runs, and the collapse of the Banco Nacional and the Bank of the Province of Buenos Aires in 1890, the Argentinian government halted the payment of foreign debt, reduced the number of banknotes in circulation, and ceased incurring foreign debt. The results were less than desirable for the economy; both the exchange rate and the export price index declined, and industries were hurt by the still-rising wage level (Bernholz 147). Eventually, in 1899 the Argentinian government passed a conversion law requiring the exchange of 227.27 paper pesos for 100 gold pesos. Bernholz notes that there was not enough gold to maintain this conversion rate, but that it did not matter, for the currency was still undervalued. Argentina went on a gold buying spree, and embarked on a period of high economic growth.

Switching to a metallic standard works because it forces a limit on how much money can be created by the government or central bank (if the country has one). Since little gold is introduced into the money supply each year compared to the amount of paper money that can be printed, it’s a decent way of putting the brakes on inflation and restoring trust in your economy.

Yet another way to end your inflation, according to Bernholz, is to create an independent central bank (Bernholz 157). A central bank is in a position to create and remove money from the economy; it acts as a lender of last resort, should it need to; and it can efficiently regulate the economy and the money supply (hopefully) without interference from political goals that might otherwise destabilize a currency. As we’ve seen in this class, this is often an unrealistic goal—and the appointment of Arthur Burns as Chairman of the Federal Reserve in 1970 is a very good example of why. Despite Burns’ belief in the quantity theory, as his student Friedman was, he was pressured to finance America’s war in Vietnam by printing money—which lead to massive inflation in the mid-1970s.

So is inflation good for an economy? Or does it hurt the economy more than it helps? There are very good arguments for both sides. Personally, I believe that a constant inflation is more or less a requirement for the U.S. economy as it stands today. We’re not about to cut our spending to where it can be supported by the taxes collected by the IRS, so using inflation as a tax is about the only realistic way to maintain our massive expenditures. Is this the best idea for our country? Possibly not. But, to paraphrase Bagehot’s words in Lombard Street, we must learn to deal with the system that we have, for reforming the entire system would be extremely difficult.

Anyone can find a problem with a system. Fixing that problem is much harder.

Works Cited

Bagehot, Walter. Lombard Street: A Description of the Money Market. Greenbook Publications, 2010. Print.

Bernholz, Peter. Monetary Regimes and Inflation. Northampton: Edward Elgar Publishing, Inc., 2003. Print.

Higgins, Bryon. “Was the ERM Crisis Inevitable?” October 1993. Kansas City Federal Reserve. PDF. 8 May 2015.

White, Lawrence H. The Clash of Economic Ideas. New York: Cambridge University Press, 2012. Print.

References

| ↑1 | Notably, this failed completely in Douglas Adams’ The Restaurant at the End of the Universe; after adopting the leaf as a form of currency, and then suffering from massive inflation, a campaign to burn down all the forests was undertaken. |

|---|